Get a joint loan with easy monthly loan repayments

Are you looking to borrow immediate money from a partner or your family member? A joint loan can be the finest choice to get access to the money with ease. Combining two incomes lets you get the loan with some flexible terms by ensuring the loan improves eligibility.

Whether you are planning home improvements, managing expenses, or anything else, a joint emergency loan will be the finest choice and will also make your situation more manageable.

Both the loan applicants have equal responsibility for repayments.This will also allow you to get higher amounts combined with lower interest rates. First of all, joint loans for married couples are ideal, and also for business partners, and anyone who trusts each other in financial matters. However, having a strong co-applicant is always helpful to get better deals.

At Loanchester, we simplify everything and offer flexible terms so you will reach all your financial goals with more confidence.

Ready to take the next step? Do joint loans comparison and click below.

What are joint loans, and how do they work?

Joint loans in the UK are the most popular financial choice among people. In this method, two people apply together. However, both applicants have a responsibility when it comes to repaying the loan, and their combined incomes, along with their strong credit scores, are also considered at the time of loan approval. This factor can easily increase the chances of approval. Also, there is a possibility of getting the amount with better interest rates.

To obtain such same day loan facility, you both will be asked to provide some basic personal as well as financial particulars. Once you get support for the loan, you need to make the payments as decided. If any one of them struggles to pay, then the other needs to cover the payments without fail.

Taken as a whole, a joint loan can be the best choice for borrowing together. Nevertheless, both applicants should know their responsibilities when it comes to choosing the loan. If you manage, then these loans will help you achieve your financial goals effortlessly.

How can I check my eligibility for a joint loan in the UK?

You can use the joint loan eligibility checker online to determine the chances of qualifying. It helps you choose the firm where you have the highest possibility of loan approval. Alternatively, here is the basic eligibility criteria that you must meet to get a joint loan:

-

Age and Residency

Anyone can enter into a joint loan agreement to split the liabilities. The applicants should be 18+ years old and citizens of the country. They must have been living in the UK for at least 3 years to qualify. Additionally, you must have been residing at the same address for a long time.

-

Credit history

Good credit history is generally important for a joint loan. However, you may also qualify if at least one of the individuals has a fair credit rating. It reduces the risk for the loan provider, and you may be eligible. If both applicants share a bad credit history, then you may also get the loan approval. However, the interest rates stay higher, and you cannot get a higher amount.

-

Income requirements

Individuals applying jointly for a loan must have a consistent income. Both individuals involved must meet the required earning mark to qualify. It helps analyse how much you can afford to repay, given the combined incomes.

What documents are required to apply for a joint loan in the UK?

Preparing the joint loan documents in the UK helps you get the loan quickly. It eliminates any confusion and increases the loan approval chances. Here is your joint loan document checklist to follow:

-

Registered for online banking: Both parties involved in a joint loan agreement must have a valid bank account and the linked online banking facility for swift processing. It makes the fund transfer easy and secure through the encrypted payment channel.

-

Bank statements: Every loan provider analyses your affordability based on your monthly income and spending. For that, you must provide the bank statements of the last 3-6 months that determine the amount you both can afford to repay together.

-

Income and identity proof: You must provide current employment proof of a part-time/full-time/self-employed or pensioner income to qualify. It could be a salary proof/pension slip/self-assessment tax returns.

-

Proof of identity and address: You can provide a driving license/a passport/biometric residence permit to provide your identity. Provide a scanned copy of utility bills or the Council tax bill for the address.

What are the benefits of Joint loans?

These loans prove helpful for individuals who struggle to qualify for a loan. It could be due to bad credit scores, limited credit history, etc. Here, having a co-borrower with a strong credit history, a good credit rating, and consistent income proves helpful.

Here are common loan advantages:

| Benefits | How does it help you? |

|---|---|

| Shared responsibility | A joint loan splits the repayment responsibility equally among the borrowers. If one skips a payment, it may affect the total interest and amount to pay. |

| Potentially low Interest rates | You may get a joint loan with lower interest rates. It reduces the liability for each person involved. If one of the individuals holds a good credit score and income, it may automatically qualify for affordable terms. |

| Impact on credit scores | If one of the individuals cannot pay, the other person must carry the dues. Otherwise, the credit impact on joint loans could be worse. It may affect the credit ratings and finances of both persons involved. |

| Strengthens the bond | A joint loan is an opportunity to improve your relationship with the person. It helps you understand each other better. This is important to converse openly and commit to a long-term loan agreement. Therefore, trust in joint borrowing is the most important aspect. |

| Larger loan amount | Yes, you may qualify for a higher amount as compared to a standard personal loan, especially with a bad credit history. The joint affordable capacity helps one get a larger amount for the need. |

Are secured joint loans for bad credit easier to get?

Yes, in most cases, applying for a joint secured loan will be the finest choice when you have a bad credit history. On the other hand, it is generally easier to get if one or both borrowers have past credit issues. Subsequently, these loans need collateral, such as a home, car, or savings. Nevertheless, joint loans for debt consolidation are also perfect.

In this type, you provide added security in case of any missed payments. These characteristics also decrease the risk involved in the procedure, making approval effortless even with an imperfect credit score.

The collateral plays a vital role when choosing these types of bad credit loans. If the asset is valuable, then you will get better terms, like lower interest rates and longer repayment periods. Still, both applicants need to meet certain requirements, such as income, to qualify.

If payments are not made on time, then you will lose your collateral. This means both borrowers must commit to making the repayments.

Before you apply for a joint loan, it is important to choose a direct lender like us and also check eligibility requirements. This will help you both to check whether you can make the repayments peacefully.

Discussing your financial responsibilities in advance lets you stay free from future issues. While secured joint loans for couples with bad credit increase approval probability, it also comes with better financial responsibility.

Is it possible to get an unsecured joint loan in the UK?

Yes, you may get joint unsecured personal loans without providing collateral. It is an ideal option for someone who can repay the dues without defaulting.

- Meet basic affordability: Both persons involved must meet the basic affordability criteria. Here, at least one of the persons must have a higher income than the other. It is essential to get better interest rates on the loan.

- Consider the relationship with the co-applicant: You can move ahead if you are sure about the person’s financial status and reliability. It is especially important when seeking unsecured joint loans with bad credit scores. Having someone you can tap on in case of uncertainties helps in repaying the loan easily.

- Transparency from the co-borrower: You can get a personal joint loan for bad credit if the other person agrees to provide personal and financial details on the loan. It would help you establish the reliability of the loan payments.

- Flexible repayment options: We provide flexible options to repay the joint unsecured loans in the UK. You may either halt the payments and ask the other borrower to pay on your behalf or reschedule the loan agreement according to what you can afford.

What occurs if one applicant withdraws from a joint loan application?

If one person wants to take out from a joint loan application before approval, then the complete process is straightforward.

In this scenario, the remaining applicant needs to submit a new application as a sole borrower. Then, the loan amount will be offered based on a single income as well as the credit profile.Without a doubt, this also affects approval chances, loan terms, etc.

Nevertheless, if the loan amount has already been permitted or disbursed, then removing a co-borrower is really complicated. Most of the time, you will not be allowed to remove the co-applicant, and your application will be declined. If you need the loan, you must cover the financial criteria independently.

If the loan agreement lets a co-borrower be removed, then you will be asked for proof that you can handle repayments alone. This also involved the process of submitting updated income statements, as well as your credit reports. Sometimes, you will be asked to offer additional financial documents based on the situation.

If one person exits, then they may be legally responsible for paying debts. Knowing these factors can help avoid financial and legal problems. Use the joint loan calculator to examine the exact amount, which will allow you to stay free from crises.

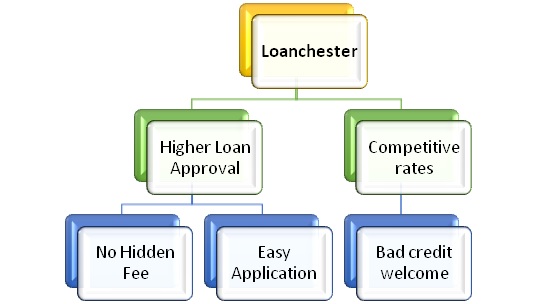

What makes Loanchester the best option for joint loans?

At Loanchester, we are committed to providing tailor-made solutions based on your exact situation. We even make joint application loans simple, affordable, and accessible to all borrowers.

Here are some of the key aspects of why we are the perfect choice:

- Higher Approval Chances: By considering both applicants’ profiles, we also ensure the likelihood of loan approval, even with bad credit histories. However, we also offer some flexible terms.

- Competitive Rates: Joint personal loans are also offered with fair and affordable interest rates. This also helps you handle all your monthly loan repayments without any stress.

- No Hidden Fees: No wonder we always believe in transparency. This also ensures no unforeseen charges or hidden costs.

- Quick & Easy Application: Our online process is easy to follow, allowing you to apply and make a decision in minutes.

- Bad Credit Considered: We have the perfect solution for everyone. We assess applications based on their repayment ability despite credit. This factor also makes our loans accessible to many borrowers.

At Loanchester, we are focused on helping UK residents to get financial support when needed. Contact us to get precise deals to cover your financial needs.

FAQS

How soon can we get a decision on our joint loan application in the UK?

You generally get a joint loan with an instant decision if you provide authentic details. We will offer the quote soon after you apply with us. Re-check the form details, documents, bank statements, email IDs, and account number that you provided for the loan. A mere discrepancy may affect the timeline to get the loan on the same day.

Can we get a joint debt consolidation loan?

Yes, you may consolidate debts jointly if one of you wants to get rid of the debts but cannot get a loan individually. It could be due to a limited credit history or pending payment. Explore the best joint debt consolidation loans in the UK by pre-qualifying. Usually, couples can benefit from this type of loan. You can join your partner in paying off the dues and reducing liabilities.

Are joint loans available for couples with bad credit?

Yes, you may get joint loans for bad credit in the UK as a couple. It is possible if one or both of you share a bad credit history. You may get a limited amount with high interest rates. There could be restrictions on what you can borrow and the timeline as well. Explore your options and use a loan calculator to determine the right loan amount to borrow. We provide bad credit joint loans to people with consistent income and improved finances.

Can we pay off a joint loan early?

It is possible to make the payments early to save money in the long run. Sometimes, you will be charged extra as the prepayment fees or penalties. Before paying off the loan before the time, check the loan terms. This will allow you to confirm there are no extra costs. Early repayment is always an ideal choice for saving money on interest, and it advances financial stability.

What are the risks of a joint loan?

Usually, the main risk of a joint unsecured loan is shared responsibility. If any one of the borrowers fails to make payments, then the other person must cover the full amount. This will make the situation more difficult. Missed payments also lead to complications that affect both credit scores. Furthermore, financial disagreements may cause some potential conflicts.

Do both applicants need to be employed?

Not essentially. Of course, if both applicants are employed, then it can surely improve approval chances, but direct lenders like us still accept alternative income sources. This also includes pensions, benefits, or investments. At least one borrower needs to have a stable income to get a joint loan.

Are joint loans available for self-employed people in the UK?

Yes, self-employed individuals may apply jointly for a loan if they earn a regular income, part-time, or have multiple earning streams. Here, you can enter the self-employed joint loan with your spouse or business partner. Individuals with a business plan, revenue statistics, profit and loss statements, and assets may get easy approval.

Does a joint loan improve credit scores?

Absolutely, this can also improve both applicants' credit scores if the payments are made at the right time. Reliable repayments also show you as a responsible borrower, which will allow you to get better loans with the finest terms in the future. However, late or missed payments surely negatively impact credit histories.

Can I compare joint loans from different lenders?

Yes, comparing your options by exploring them is helpful. It helps you shortlist the best joint loans in the UK that you may qualify for affordably. Check the quotes by pre-qualifying. Keep the joint loan partners’ and your finances at the centre during the joint loans comparison process. It helps you spot the loan that is affordable for both.